The Trade Management Secret That Separates Winners From Losers

Here is a secret that most trading gurus will not tell you: trade entry barely matters. What separates profitable traders from the 90% who fail is one thing - trade management. Last week, Maya took four losses. And that is exactly why Maya's portfolio continues to grow. Those four trades closed at -12%, -16%, -10%, and -14%. Without systematic stops, they could have been -50% to -80% disasters. This is not luck. This is process.

Why Trade Management Matters More Than Entry

Most traders obsess over finding the perfect entry. They spend hours analyzing charts, looking for that 'sure thing.' Here is the uncomfortable truth: there are no sure things. Even the best setups fail 30-40% of the time. What separates professionals from amateurs is not better entries - it is better exits. Maya's edge is not in finding trades. It is in managing them ruthlessly once they are open.

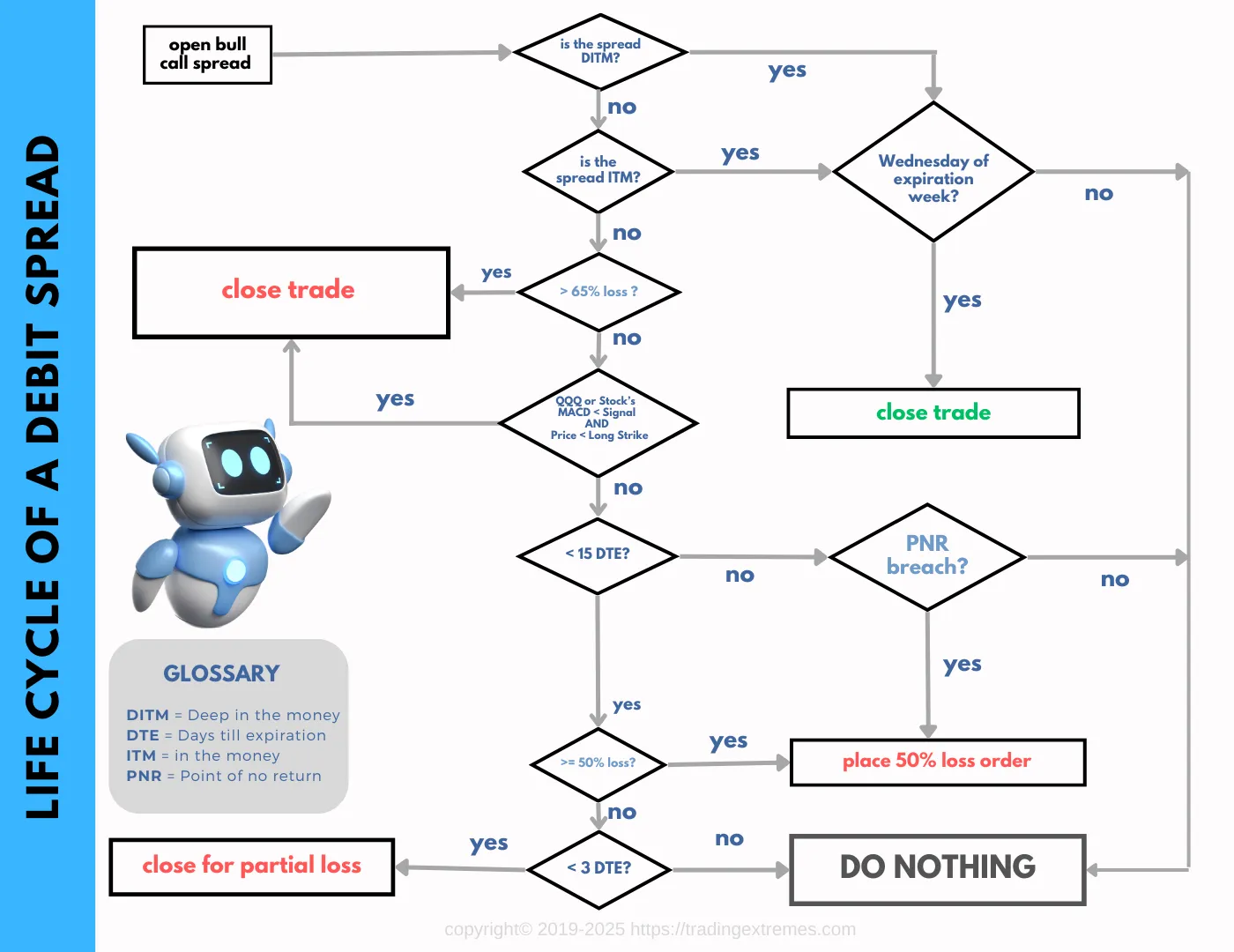

Maya's Trade Management Flowchart: The Secret Sauce

Every single trade Maya takes follows this systematic decision tree. No exceptions. No emotions. Just rules.

Maya's systematic trade management flowchart - the real reason for consistent results

This flowchart is not just a guide - it IS the strategy. Every position is evaluated against these rules twice daily. When a rule triggers, Maya acts immediately. No second-guessing. No hoping for recovery. Just execution.

Maya's 9 Exit Rules That Protect Your Capital

Maya uses NINE different exit triggers - this is why losses often get cut at just 2%, 4%, or 8%, way before traditional stop losses:

- Profit Target: Lock in gains at 94% ROI

- PNR (Point of No Return): Exit early when price crosses danger zone (often 2-8% loss)

- MACD Reversals: Exit when momentum shifts against the trade

- Earnings Guard: Exit 7 days before earnings

- Dividend Shield: Close bull calls before ex-date if assignment risk exists

- Expiry Week: Close all positions by Wednesday of expiration week

- QQQ MACD: Exit when market momentum turns bearish AND price below long strike

- DTE Stop: 50% stop loss when 15 or fewer days to expiration

- Hard Stop: Absolute exit at 65% loss (rarely reached because other rules trigger first)

The key insight: Most traders only have ONE rule (the 50% stop). Maya has NINE rules working together, which is why the average loss is so much smaller. Look at Maya's trade history - you will see trades closed at -4%, -7%, -12%. These are not failures. These are the PNR rule, the MACD rule, or the earnings rule doing their job.

Trade: COST - Cut at -20%

What Happened

COST was showing promise in its bull call spread, but the stock price turned against Maya shortly after entry. The initial analysis indicated a strong upward potential, but unexpected market conditions shifted sentiment, causing the price to drop. Maya recognized the change quickly, allowing for proactive management of the position.

Understanding the PNR Rule

The PNR (Point of No Return) rule is designed to minimize losses by identifying critical levels where the price movement suggests a potential reversal. It is calculated based on the strike prices and current volatility, triggering an exit if the price crosses a defined danger zone. This rule acts as an early warning system, ensuring that Maya cuts losses before they escalate, typically at 2-8% losses.

How It Played Out With COST

On January 15, Maya's PNR triggered at -20%. The position was closed immediately - no hesitation, no hoping for recovery, just systematic execution of the rule.

Without this rule: The price continued to drop, leading to further loss beyond -20%. The position could have spiraled into a -50% loss, significantly impacting Maya's overall capital. By exiting at -20%, Maya preserved crucial capital for future opportunities.

Trade: ACN - Cut at -20%

What Happened

ACN exhibited a bullish setup upon entry, yet market volatility led to a sudden downturn in stock price. Despite initial favorable conditions, external factors influenced a rapid decline, prompting Maya to reassess the position. Recognizing the shift, Maya acted based on established rules to mitigate loss.

Understanding the MACD Reversal Rule

The MACD Reversal rule leverages the Moving Average Convergence Divergence indicator to detect shifts in momentum. When the MACD line crosses below the signal line, it signals bearish momentum, prompting Maya to exit the position. This systematic approach helps prevent small winners from turning into significant losers.

How It Played Out With ACN

On January 20, the MACD Reversal triggered at -20%. The position was closed immediately, adhering to the discipline of the established rules.

Without this rule: Holding through the reversal could have resulted in a further decline, potentially hitting a -50% loss. This exit preserved capital, allowing Maya to reallocate funds to more favorable trades.

Trade: NFLX - Cut at -45%

What Happened

NFLX appeared to follow a bullish trajectory initially; however, the stock quickly reversed course due to unforeseen market events. As the price began to decline, Maya utilized exit rules to minimize the impact of the loss.

Understanding the Hard Stop Rule

The Hard Stop rule serves as an emergency measure when other exit criteria fail. Set at a 65% loss, it acts as a final line of defense to protect capital. Although rarely triggered due to more proactive rules, it ensures that no position can lead to catastrophic losses.

How It Played Out With NFLX

On January 28, the Hard Stop triggered at -45%. Maya executed the exit without delay, reinforcing the importance of discipline in trade management.

Without this rule: NFLX could have continued falling, leading to substantial losses beyond -45%. The systematic approach to exiting at defined thresholds allowed Maya to mitigate damage and protect overall capital.

The Math: Small Losses, Big Protection

Here is why cutting losses early matters so much:

Share this post

Comments 0

Leave a Comment

No comments yet. Be the first to comment!

Stay Updated

Subscribe to our newsletter for the latest trading insights and updates.

Get 50% Off

Enter your email to receive your exclusive coupon code for 50% off your first month of trade alerts.